Airdrop Mania Is Here… What Did You Get?

The markets went crazy while many airdrops were announced

Hey there,

Another crazy week has passed with crypto now looking to be a safer asset than banks. Here’s a recap of what happened so far.

The Top Story: Airdrop frenzy arrives

The long-awaited Arbitrum airdrop is finally here, and you can check out your eligibility here.

Unfortunately, I was too lazy to perform any transactions on Arbitrum, so I did not qualify for any tokens.

An airdrop that I would hopefully qualify for was Space ID’s $ID token, which was just announced too.

The ID token would be released on the Binance Launchpad as well, which is the 30th project to launch a token sale on the platform.

Space ID declared that a part of the token’s allocation would be distributed to the community, with details to be released soon.

Space ID is similar to the likes of Unstoppable Domains or ENS, which allows you to set a crypto-friendly address in place of your extremely long address (which usually starts with 0x).

This will help to reduce errors when you are sending funds to a wallet address, and you can sign up for a domain with my referral link.

Let me know in the comments if you’re eligible for either airdrop!

Another potential airdrop that you can participate in is the Sei Network, and they have just released their Sunken Treasures NFT campaign.

You can check out my guide here on how to qualify for this airdrop at no cost to you.

Other Interesting News

Apart from the multiple airdrops being announced, here are some other fascinating stories from the past week:

Everything’s fine for Circle, but at what cost?

After the US decided to save SVB, Circle was able to access the entire $3.3 billion that they had deposited in the bank.

While this helped prevent further bank runs, it does raise a lot of questions regarding the financial system and how the government suddenly had enough funds to save SVB.

CZ, the CEO of Binance, mentioned that they will be converting the remaining of their Industry Recovery Initiative funds from BUSD into BTC, BNB and ETH.

This was one of the main catalysts that sparked the latest bull run, as crypto prices skyrocketed even when the TradFi scene seems to be in turmoil.

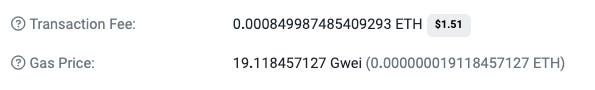

What I found most interesting was that it just cost $1.51 in gas fees to transfer $980 million BUSD from Binance’s wallets to the Recovery Fund wallet.

In another interesting move, Binance seems to be promoting the TUSD stablecoin, as its BUSD stablecoin seems to be dead.

The wars are heating up for stablecoins as faith in USDC is crumbling, while USDT is still taking the number 1 spot.

Coinbase opens more doors for Singaporeans

After receiving an In-Principle approval for MAS’ Digital Payment Token (DPT) licence, Coinbase has added more features for Singaporeans.

You can now use SingPass to sign up for a Coinbase account, which helps to shorten the onboarding process.

What’s more, Coinbase has partnered with Standard Chartered to offer SGD deposits and withdrawals.

This partnership comes amidst the ongoing collapse of US banks, as Coinbase looks for more trusted partners to provide on-ramp and off-ramp capabilities.

You can check out my first look at these features in my video below, as well as how it compares with Crypto.com’s SGD deposit and withdrawals.

stETH withdrawals finally could come in May

The long-awaited upgrade to the Ethereum network could finally be coming in April. This was sort of confirmed by Tim Beiko, one of the major developers of the network.

With this announcement, Lido Finance announced that mainnet withdrawals of its liquid staking derivative (LSD), stETH, would be around May (2 weeks after the Shanghai upgrade is implemented).

If you’ve staked your ETH with Coinbase, they seem to be much more confident and will be enabling withdrawals as early as 24 hours after the upgrade.

LSDs are one of the main drivers in DeFi, and let me know in the comments if you’ll be unstaking any ETH you’ve previously staked.

I did not stake any ETH because of the crazy gas fees, so I’m kinda missing out on quite a lot of opportunities.

Uniswap launches on the BNB Smart Chain

After a few weeks of discussion, Uniswap has finally launched on the BNB Smart Chain, making it the 6th chain that you can use this decentralised application (DApp) on.

This is one of the benefits of EVM-compatible networks, where it makes it really easy for developers to port their projects across any of these networks without changing much of its code.

Uniswap has also announced its mobile wallet, which could help to further onboard more users on the BNB Smart Chain.

PancakeSwap is the major decentralised exchange (DEX) on the BNB Smart Chain. With Uniswap being the largest in terms of trading volume, it remains to be seen how much market share it can take from PancakeSwap.

The BNB Chain consists of both the BNB Smart Chain and the BNB Beacon Chain, and you can find out what the differences are between them in my video below 👇

Access DApps from anywhere with this new development

Based on sanctions and other regulatory rulings, you may be unable to access certain decentralised applications based on your location.

This could change with the new Web3 URL domain on Ethereum, which allows any DApp to be accessed using the web3:// domain.

This could be really useful if certain https:// websites are blocked in your country, such as https://app.aave.com/ or https://app.uniswap.org.

Scam Spotter

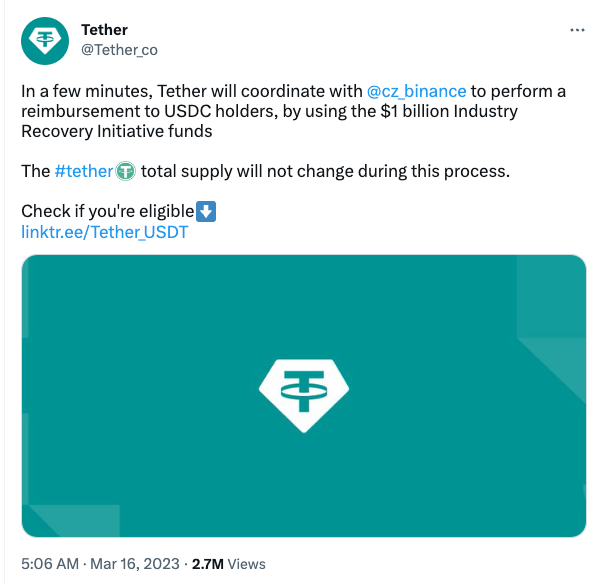

There are lots of scam tweets that are trying to take advantage of the USDC depeg.

Some of them that I saw include this tweet about Tether.

Do be extremely careful and it’d be best to double-check the URLs that you’re clicking.

This tweet links to a Linktree profile, but the domain of the phishing site directs you to https://tether-usdt.co/, while Tether’s official website is https://tether.to/en/.

With multiple airdrops being announced, hackers have also taken the opportunity to

Other Cool Stuff

Account abstraction is the latest trend in Web3, and it has made a breakthrough after it was recently launched on the Ethereum network.

If you’re still confused about how account abstraction works, you can check out this great blog post that makes it really easy to understand.