The 13 high-potential airdrops I’m targeting in November

Knowing how to ignore 90% of airdrops is a superpower.

There are more opportunities than you’ll ever have time for, so it’s time to choose wisely.

Here are the ones that I’ve identified as having the highest potential for a good return:

Pendle YTs

I’m still holding some YTs to earn leveraged points for different airdrops, and will see how they turn out.

This includes:

srUSDe (Strata, my pUSDe has expired so I switched over to srUSDe with the new mainnet launch)

sUSDai (Only deposited a small amount, but the Implied APY increased significantly so I’m just at a small loss)

sUSDe (I bought this on Plasma because the Implied APY is low)

Ones that I sold off:

alUSD (Almanak, Phase 2 ended and I didn’t buy the next phase’s YT)

vkHYPE (Kinetiq + Veda, since Kinetiq’s point program is over)

mHYPER (I’ve sold it after the FUD, but made a small profit from it)

My main aim is to cover the cost of my initial capital with these YTs.

So I’m focusing on YTs with an underlying APY (usually the staked ones) to get back some capital.

I shared my guide here on how YTs work.

The perp DEX meta

The Oct 11 crash was a good reminder why I shouldn’t be overexposed to trading as it’s not my thing (I’m always losing money).

Too many perp DEXes to choose from (and I don’t understand why we need so many).

I’m not actively farming any, but trading as and when to build up my points.

These are the perp DEXes that I’m doing now:

Pacifica (Solana)

Mainly because it’s new, but I’m not accumulating a lot of points from here.

Lighter

0 fees are great here, but I have not made significant volume since it’s hard to earn points.

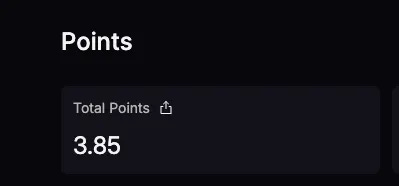

I only have 3+ points, and I’m not going to spam trades to earn more.

Hyperliquid (Builder Codes)

With the HIP-3 launch, I plan to trade some assets to increase my exposure for the S2 drop.

In particular, I’d choose to trade on a tokenless Builder platform to stack different protocols together.

But fees for HIP-3 assets are 2x vs normal assets, so it’s more expensive to trade them.

I shared my strategy for Builder Codes here.

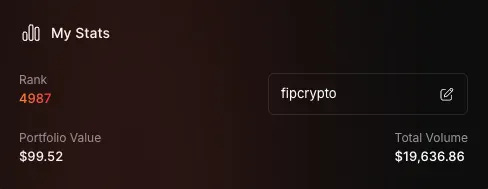

It’s surprising that I’m ranked in the top 5k even with a low trading volume, and I’ll work on pushing some trades on this lesser-known perp DEX