Unpacking the disastrous Scroll airdrop, one year later…

Scroll was one of the most anticipated airdrops in 2024, but failed to live up to the hype.

So what went wrong with the allocations and this L2 now becoming a ghost town?

I listed down the possible factors and my lessons from this underwhelming airdrop:

The ZKsync airdrop fuelled expectations

Many were upset about the allocation from ZKsync, so they started pinning their hopes on Scroll.

“You saw how badly the ZKsync airdrop was, don’t make the same mistake”.

And this likely led to more unrealistic expectations for Scroll to perform.

It didn’t help that influencers were hyped it up like crazy just because of its funding and it being another L2:

The amount of funds raised was used as an indicator that Scroll could do something similar to ZKsync.

Everyone was hyping it up too, so that made matters worse.

And it likely didn’t end well because of how their campaign was run:

Scroll gave us the formula to farm them

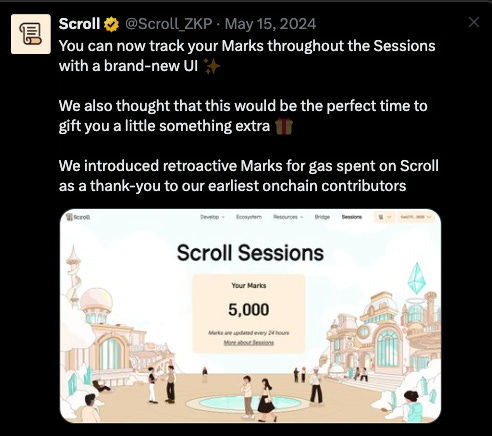

The Marks campaign was basically Scroll giving us their airdrop playbook.

Everyone knew how to farm the airdrop as they laid out the exact criteria to earn points.

I’m not a fan of such campaigns because whales and Sybils will outcompete real users in these 2 scenarios:

The capital requirement is high (whales will dominate)

The tasks are too easy (Sybils will dilute the pool)

Scroll basically told everyone to bridge their funds into the L2, because they valued liquidity the most.

For shrimps like me, we did get a nice head start based on our retroactive gas spend:

But there were likely diluted once whales caught wind and bridged their funds over.

This turned Scroll Marks into another PvP competition like Orderly’s Merits or deBridge’s seasons:

Those who can put in the most capital will dominate in a zero-sum game.

While for ZKsync, we were going in blind:

They didn’t mention their airdrop or host any official campaigns in their communications.

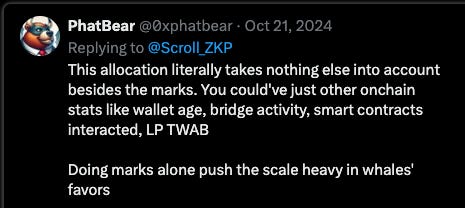

But they used a similar mechanic, Time Weighted Average Balance (TWAB) to determine a wallet’s allocation.

Moving forward, this is why I am bearish on airdrops with a point system:

Whales will dominate if the airdrop is liquidity-based and we know the exact formula for earning points.

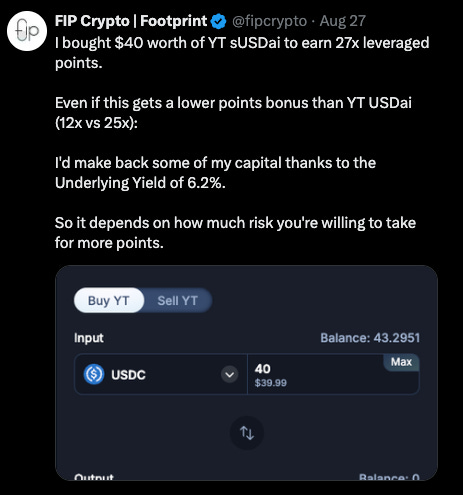

Though the exception are Pendle YTs, which give us an advantage to leverage our points yield even with limited capital.

It didn’t help that the one thing I was banking on would be totally irrelevant:

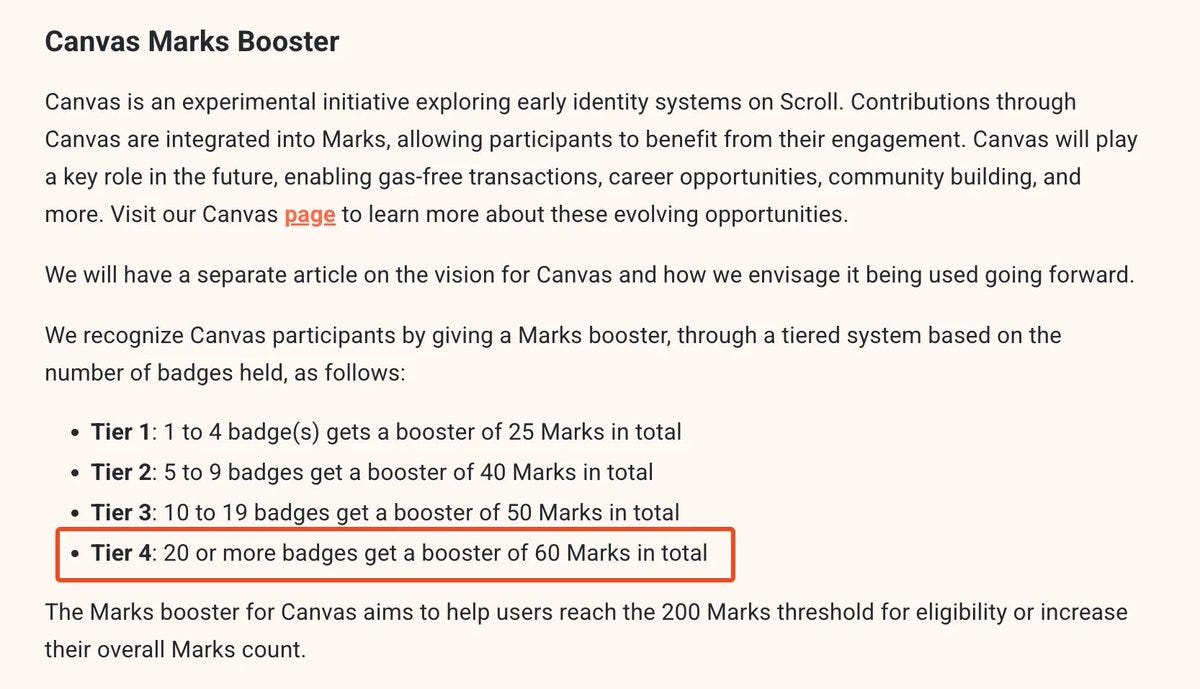

Badges turned out to be useless

I knew from the start that I won’t win the Marks game.

The caps on Aave were constantly being filled as whales sucked out all the liquidity to earn Marks.

I didn’t want to allocate a huge amount of funds into Scroll as it’s a losing battle with my limited capital.

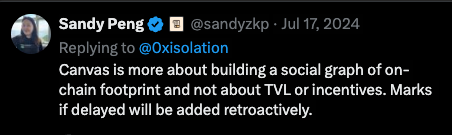

So when Scroll announced Canvas, I thought that this would be my edge:

Whales wouldn’t bother with Badges because it takes to too much time.

So I started claiming as many Badges as I could.

I thought that Scroll would award onchain footprint as another criterion,

but this was the result:

An additional 60 Marks that ultimately meant nothing.

I wasted so much time burning fees on these projects, but I’m grateful that I didn’t waste even more time by doing this on multiple wallets.

Marks were likely diluted

There was outrage over how poor the allocations were given how much capital they deposited on Scroll.

But again, it depends on the total amount of Marks.

Whales likely received the highest share and got the best allocations.

A timely lesson that there’s a huge opportunity cost for the amount that we deposit:

The yield and airdrops we get could be higher if we had used that capital elsewhere.

The toxic aftermath

It made matters worse when Sandy claimed that they’ve learnt from the mistakes of past airdrops and are determined to do it right.

But the allocation that most got seemed like they didn’t learn anything.

And just like ZKsync, everyone started hurling insults at the team, likely even death threats.

Yes, the airdrop was a major disappointment, but I don’t see a need to be toxic towards them.

I’m not perfect and am guilty of leaving sarcastic comments on their posts.

These gave me great engagement, but I soon realised that they provided zero value.

The reality was far from the expectations, and this led to the slow death of this L2:

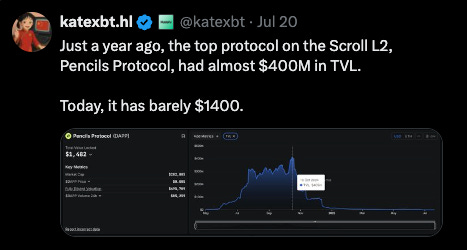

The downfall of Scroll

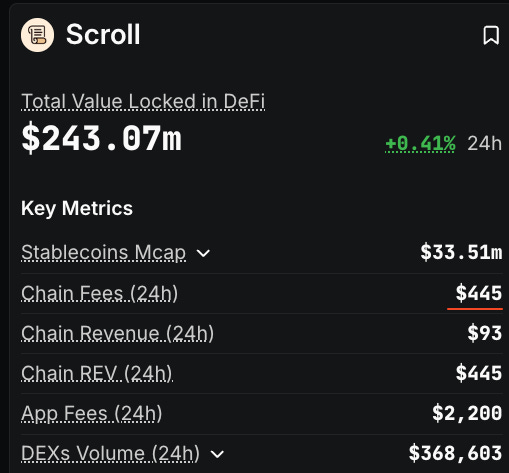

There’s barely any chatter about Scroll.

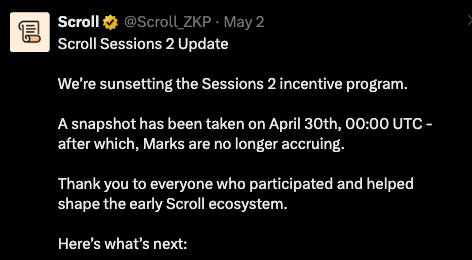

Scroll Sessions was shut down after 30 April,

and all my ‘hard work’ on the badges was useless.

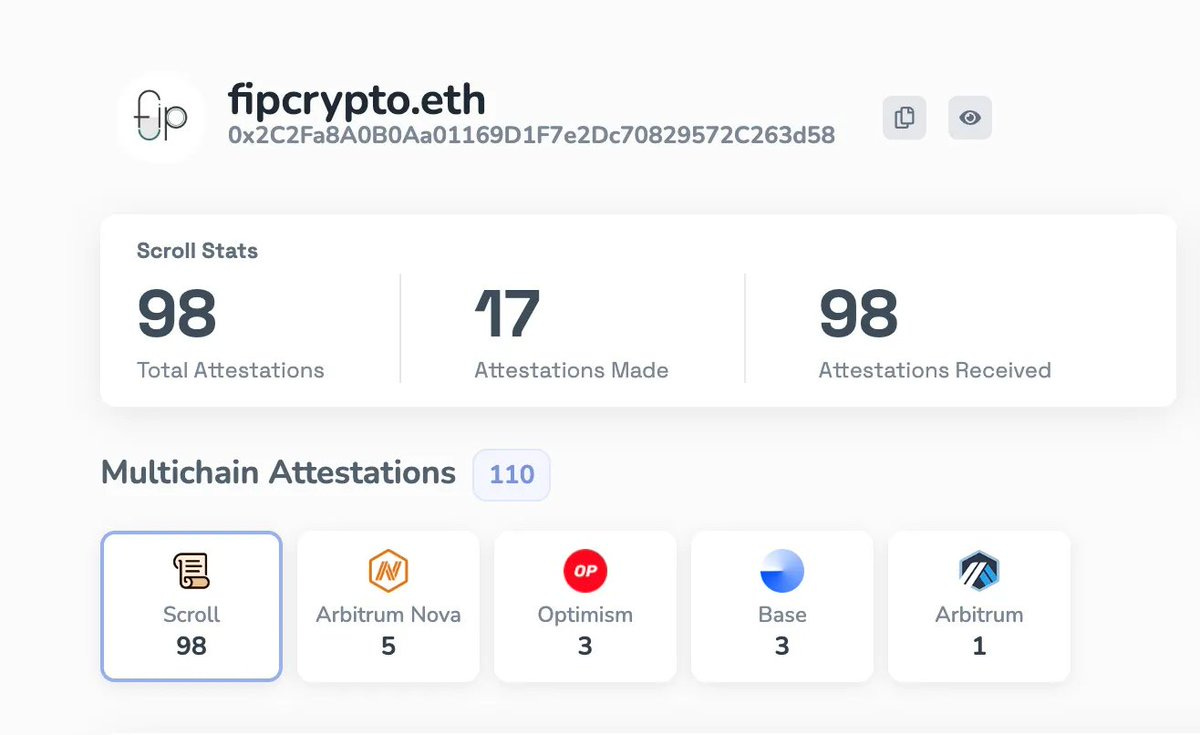

At least these Badges are seen as attestations on @eas_eth:

Everyone loves to mock Story and their $24 fees, while Scroll has slightly less than $500.

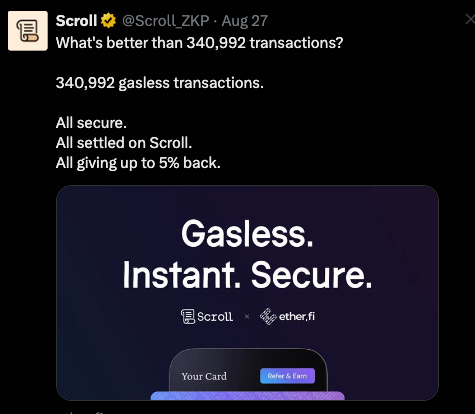

But they’re still achieving some success with the @ether_fi cashcard.

Meanwhile, other projects are dying like Pencils which barely have any TVL left.

So here are some takeaways I have from this drama-filled airdrop:

My lessons from Scroll

Avoid airdrops with known criteria

If a project gives us a formula to farm them, it will be overfarmed.

This usually happens if a project is liquidity-based and runs a points program:

Whales will dilute the points, and we would lose out.

That’s why I still prefer retroactive airdrops since there’s no known criteria.

Though I’d still ape in early into Pendle YTs for these programs, especially for stablecoin protocols:

My YT could increase in value once more wallets drive up the value.

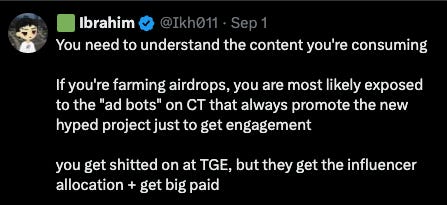

Stop doing every airdrop that’s overhyped

CT is an echo chamber, and once the algo knows that we’re interested in airdrops:

We’ll be constantly fed with engagement bait by Ardizor and his gang on the next overhyped airdrop.

That’s what happened to me when I started my journey too.

Others would shill an airdrop now because of Kaito or a referral link, and we always need to question why someone is posting about a project.

Even for me.

This highlights the importance of curating your feed and forcing the algo to serve only alpha (instead of noise).

Just because an airdrop is overhyped, it doesn’t mean it’ll do well.

I’ve made that mistake countless times, and have been disappointed with poor returns all the time.

Ultimately, this mindset will help us build a sustainable airdrop routine:

Airdrops are a bonus now

Gone are the days of projects throwing money at us just for clicking a few buttons.

Here’s my first rule of deciding whether I should do an airdrop or not:

Will I use the project even if there are no incentives?

If yes, then it’s one that I would put more effort into.

I’ve forced myself to interact with a project just because of its airdrop, and it burned me out multiple times.

That’s why I stopped doing Eclipse because there were no apps that interested me on that chain.

Airdrops have become a bonus, and I can’t just rely on them to make money.

We need to find ways of profiting from our DeFi interactions first, before getting the airdrop for interacting.

L2s can still be profitable

Scroll was one of the biggest disappointments in 2024, but I don’t think my footprint there will go to waste:

Given how it’s one of the first ZK rollups:

Future ZK rollups or ZK-based projects could reward our footprint there (though it’s never a guarantee).

After this first wave of general-purpose L2s, I’m only interacting with ones that have good apps.

Otherwise it’s just a waste of time.

Though I find that the best way of profiting from an L2 is through the modular approach:

I’m stacking exposure to multiple tokenless infra projects for modular airdrops.

I shared more about my strategy below:

If you are tired of mindless grinding for airdrops, build a reputation that compounds (instead of burning out), and earn rewards just by being yourself: